Indonesian Bird's Nest Exporter Plans to List on the Stock Exchange

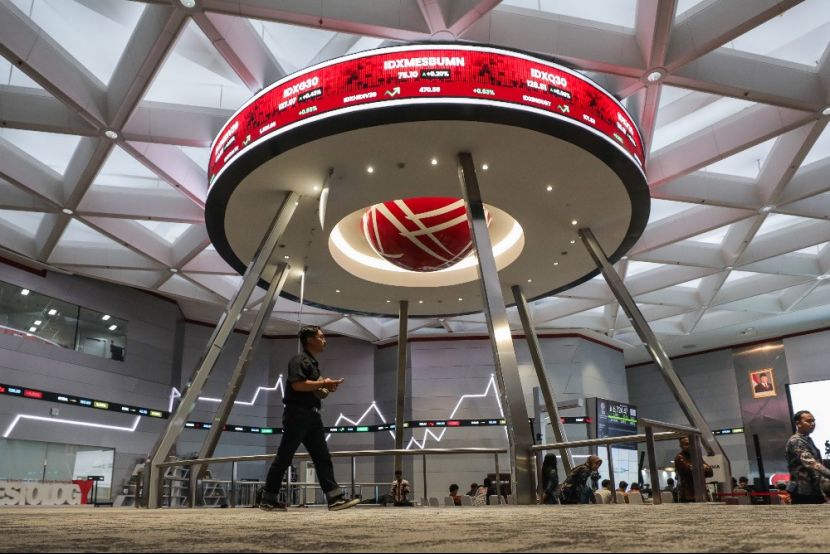

Bird's nest exporter PT Abadi Lestari Indonesia Tbk.(RLCO) will be listed on the Indonesia Stock Exchange (BEI).Its initial public offering (IPO) was priced at Rp168 per share, with 625 million shares issued, raising a total of Rp105 billion. According to the prospectus.All proceeds will be used to purchase bird's nest as working capital: 56.331 TP3T for the company's own working capital and 43.671 TP3T injected into its subsidiary PT Realfood Winta Asia (RWA) for the purchase of bird's nests, with RLCO holding 93.751 TP3T in RWA.

The management said that the company has transformed itself from an exporter of raw materials to anLeader in Consumer HealthRLCO is a "Superfood" producer, which is in line with consumer preferences and health needs. Analysts believe that RLCO is fundamentally sound, belongs to the consumer sector, and its profitability has improved significantly: net profit margin has stabilized at around 19% since 2023 and is expected to continue this year; debt-to-equity ratio (DER) has decreased from 11,72% in 2023 to 8,80% in 2024 and is expected to further decrease to 1,53% in 2025; it is expected to perform well in comparison to its peers. Good performance compared to peers, expected to be favorable on the first and second day of IPO.